Crafting an end-to-end insurance lifecycle platform, driving 12% revenue growth and a 26% boost in underwriting efficiency

Background

To maximize topline growth, ISC must enhance visibility into coverage options, increase broker productivity, streamline underwriter operations, and enhance customer support.

ISC is shifting into a growth phase, focusing on scaling its offerings and market presence. There was an opportunity to reimagine how insurance can be sold in B2B and B2C markets.

Business Need

Leadership plans to create a whole new experience to increase visibility of insurance offerings and speed up Broker and Underwriter workflows.

Solution

Empower brokers to bring in more business and underwriters to review applications more quickly.

Impact

Revenue

Underwriting efficiency

Faster design task completion

Background: Insurance Application Process

User Journey Flow

Information Architecture

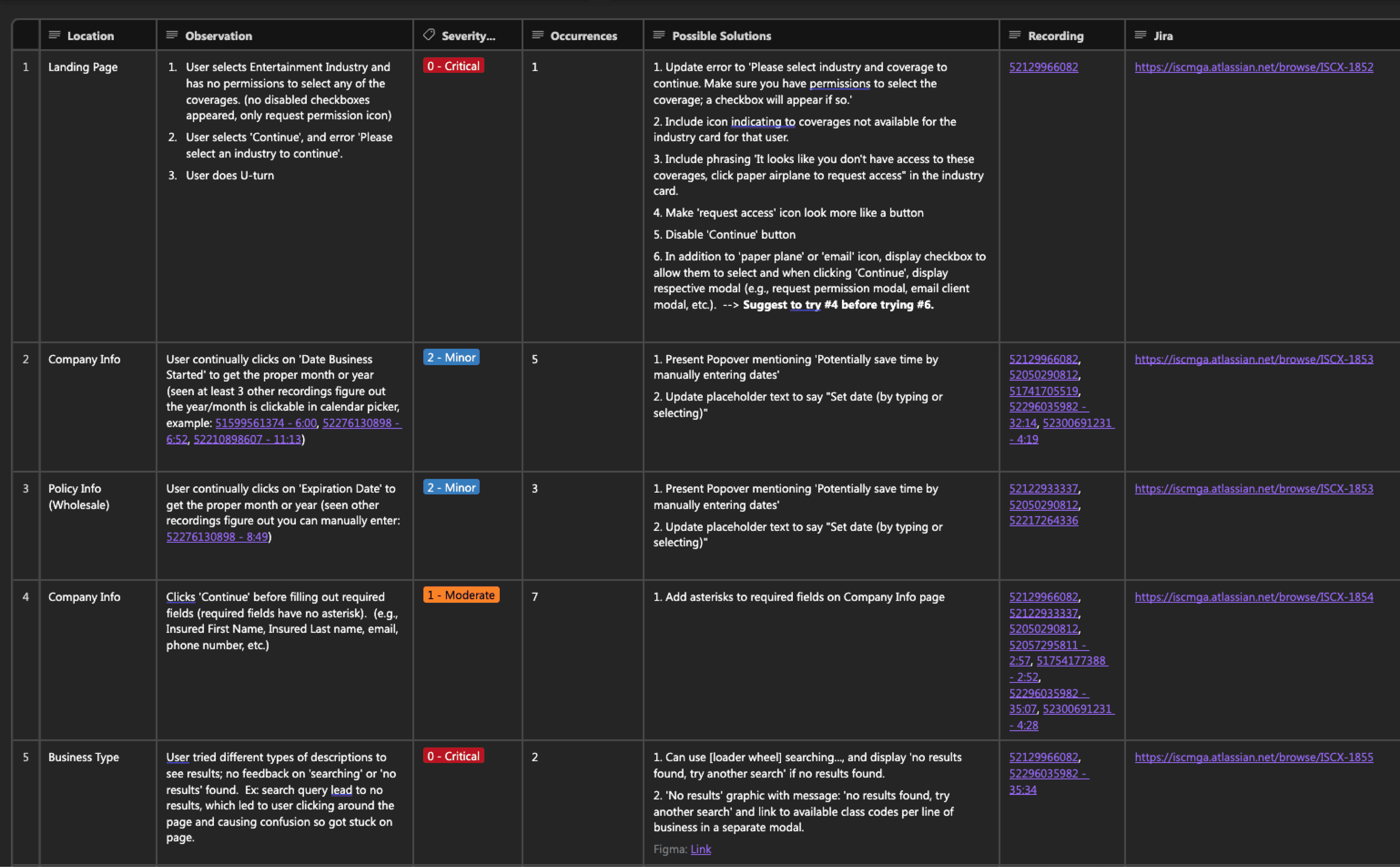

I identified the sections that contain the most application questions with the product manager using an information architecture diagram. These diagrams map the questions per section to help me strategically think how to group sections across different pages to prevent overwhelming the Agent with long lists of questions.

Solutions

Acquisition - Getting Users

Marketplace Landing Page

•

Increase product discovery for brokers to quickly identify and view all available coverages within ISCx Marketplace.

•

Provide ability for brokers to quickly view additional information per coverage (e.g., coverage and limits).

Activation - Helping Users See Value Quickly

Quick Price Indication

•

Giving a quick price indication to brokers before having to fill out a whole insurance application, which helps convert leads for new business or renewals.

Engagement - Keeping Users Active

Broker Center

The features listed below increased broker retention by increasing their conversion rate:

•

We found filtering by 'E-sign' helped prioritize which leads to follow up, thus driving lead conversion.

•

Sorting: we found that sorting by 'Created Date' in descending order also drove high lead conversion rate.

Customer Support Center

•

Designing and building a Customer Support Center helped us increase revenue by 4% by expanding into B2C insurance.

Retention - Encouraging Repeat Use

Application Questions: Reducing Cognitive Load

•

Strategically dividing application questions to balance length of pages and reducing scroll for application questions.

Underwriter Submission View

•

Providing the underwriter qualitative data metrics to make quick, informed decisions on whether to approve or decline insurance applications.

Enabling Design Execution

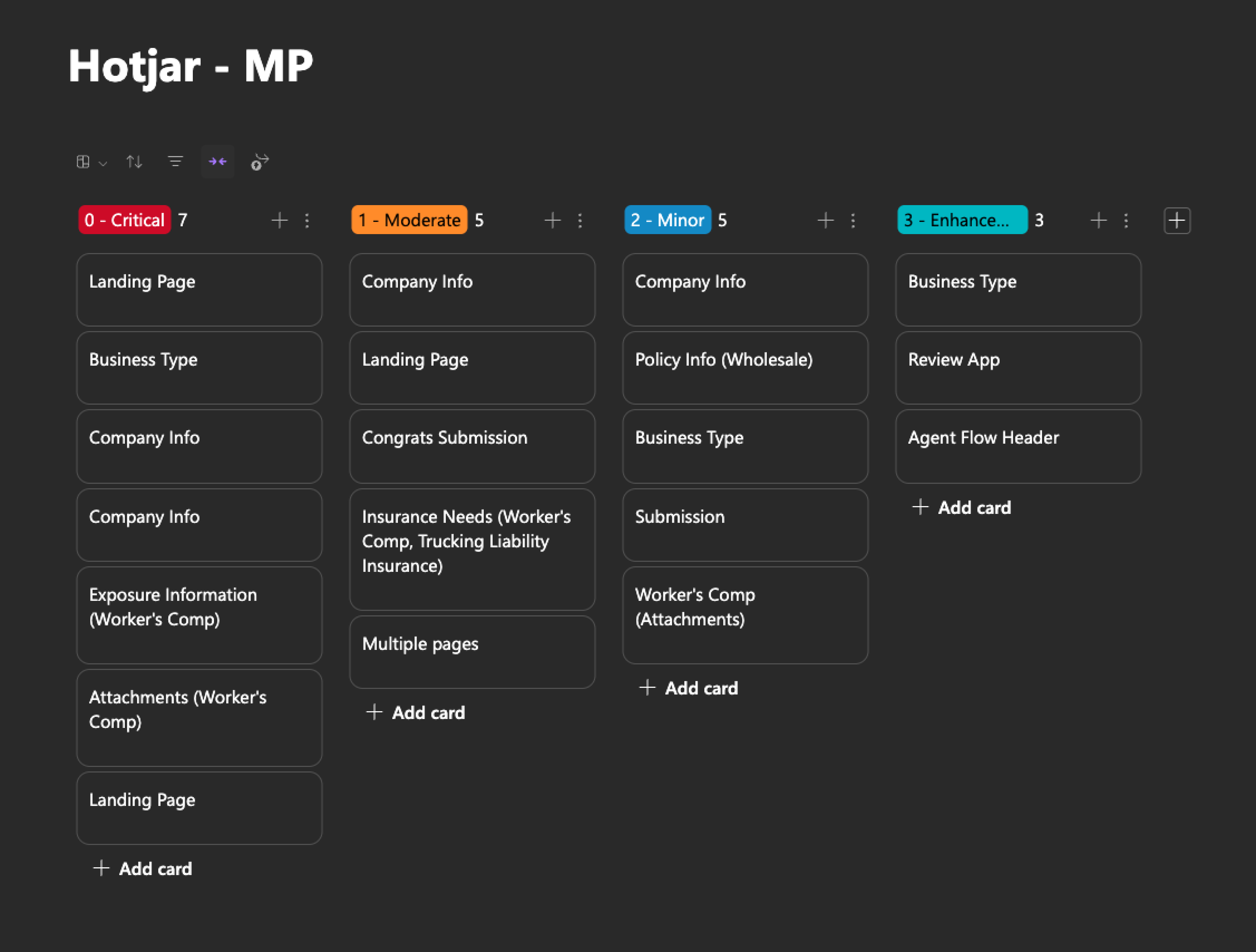

Hotjar User Behavior Tool: Data-driven Product Design

Beta Users

Voiced similar points

Used Hotjar to gather user feedback and analytics

Improvement #1: Endorsement Redesign

Underwriters want to be able to group endorsements by effective date for a simplified review process and to gain clarity on changes to an application. Underwriters also want to be able to see which endorsements will impact costs.

Endorsement History - Original Design

Endorsement History - New Design

Improvement #2: Underwriters expressed frustration with having to manually verify duplicates of insured applications.

We added the feature to detect existing insureds when entered with a similar 'Company Name' that an Agent has entered in the past. This prevents having duplicate applications for one insured customer (e.g., will no longer have two applications with company name "Cyberdyne Systems" and "Cyberdyne Systems LLC").

Design System

Design time decreased by having clear documentation of a design system, leading to increased productivity and completion of design tasks by 2x.

Results

• Boosting underwriting efficiency by 26%

• Increasing broker production by 14%

• Providing customer support for B2C insurance